Power BI Edmonton City Property Evaluation Comparison by Rahul Singh

The city is expected to collect just under $2.3 billion in property taxes, with $496 million of that being collected on behalf of the government of Alberta for provincial education. Story.

What do Edmonton's property assessment values tell owners? Edmonton

Property Values and Assessment Notice Open All Close All Where can I view the information used to calculate my property's assessed value? What should I do if I have not received my assessment notice? How do I access a copy of my property assessment notice? My property is in the recently annexed area.

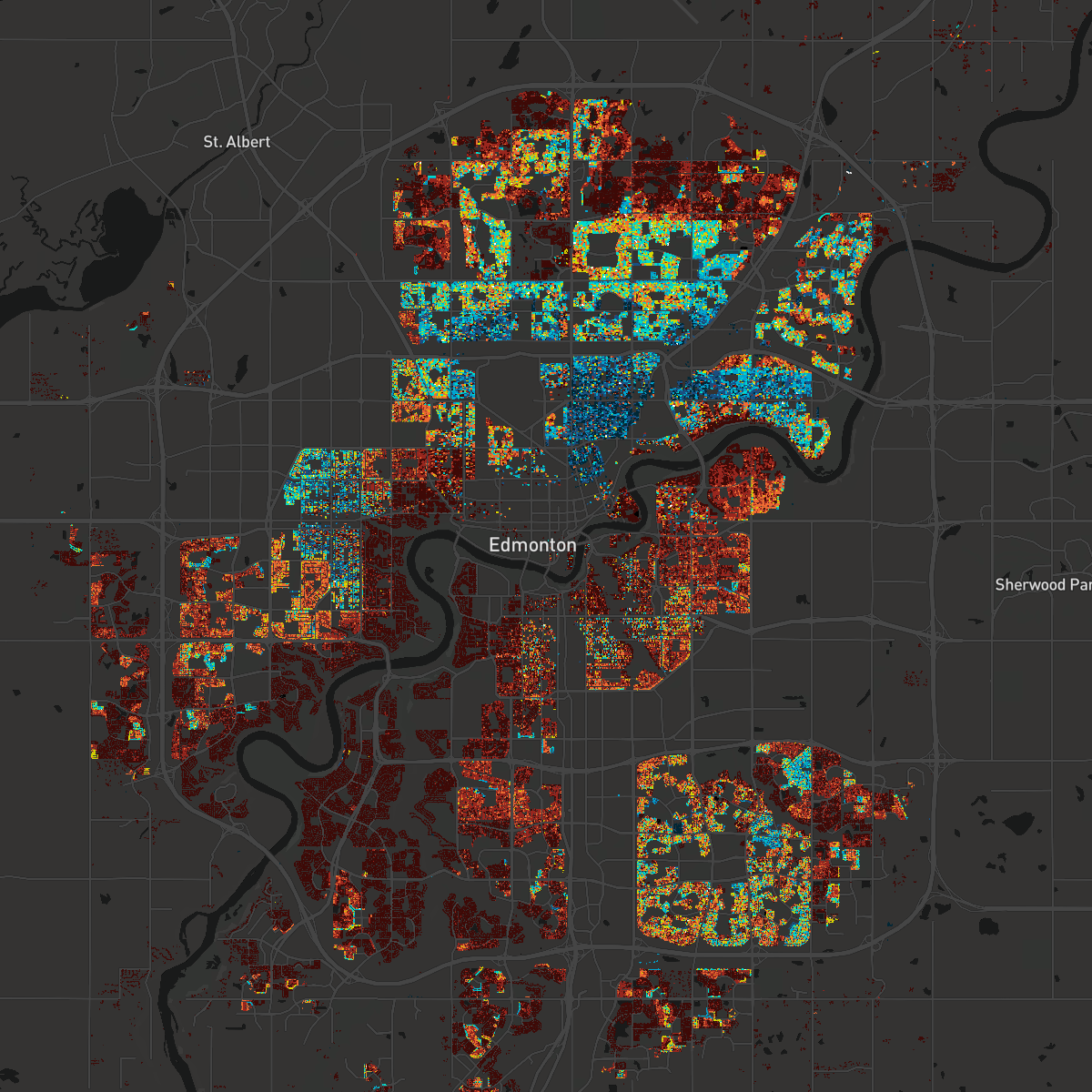

Property Assessment Edmonton Map STAETI

Your Property Assessment Notice When you receive my notice. Review the details on your assessment notice. Check what makes up your property's assessment value and compare it with similar properties in your vicinity using myproperty.edmonton.ca. Contact the City for one-on-one support by calling 311 (780-442-5311, whenever outside Edmonton).

City of Edmonton releases 2018 property assessment notices YouTube

Assessment and Taxation Assessment and Taxation Branch provides citizens with a fair and transparent means to share the cost of civic services essential to a vibrant and growing city. Branch Mandate The Assessment and Taxation Branch works to ensure fair and transparent property assessment and taxation that meets provincially legislated standards.

Assessment of Properties City of Edmonton

Step 1: Request a Property Tax Monthly Payment Plan application form. Online By calling 311 (780-442-5311, if outside of Edmonton) Step 2: Complete the application form—unique to your property and tax account and sent to you by the City of Edmonton within 3 business days.

City Of Edmonton Property Value Map PRORFETY

Property Assessment Data Historical is a dataset that provides the historical property assessment values for residential and non-residential properties in Edmonton from 2005 to 2020. The dataset is available on the Edmonton Open Data Portal, where users can explore, download and visualize the data. The dataset can help users understand the trends and changes in property values over time and.

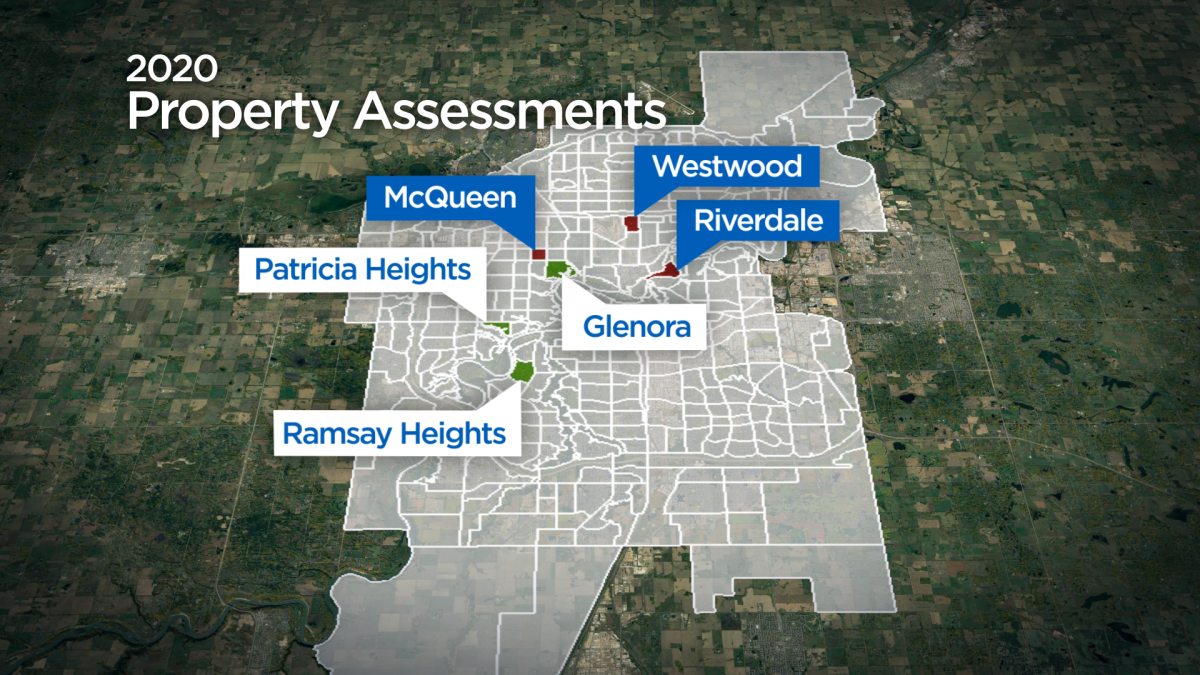

2020 assessments in the mail; what Edmonton property owners need to

Monday to Friday. 8:30am-noon and 1pm-4pm. Please note the office will be closed over the lunch hour. Telephone. 780-496-5026. Fax. 780-496-8199. Email. [email protected].

2020 assessments in the mail; what Edmonton property owners need to

Sign up or sign in to explore your property assessment and tax data. Check this bird's-eye view of assessed values for all properties in Edmonton. See how much a property of a certain value is estimated to pay in property taxes this year. the details on your assessment notice.

Edmonton Property Assessment Comparison 20152016 Elisse Moreno

First Name Last Name Email Phone What type of inquiry is this? I just have a general inquiry My inquiry is specific to a particular property Please provide details: FOIP Statement Personal information is collected for the purpose of Assessment & Taxation related inquiries and will be used to address your inquiry or action your request.

Pin on Dwight Streu, Edmonton Real Estate Agent

This secure website enables you as a property owner in Edmonton to obtain assessment information specific to your property. The City of Edmonton uses many variables to determine the value of your property. Once you are signed into the secure website, you can access reports on physical characteristics and assessment details of your property and

2020 assessments in the mail; what Edmonton property owners need to

Property Tax. Telephone. In Picton: 311. Outside Edmonton: 780-442-5311. Online. Submit Inquiry. TTY. 711. Resources pertinent to property assessment and taxation for City of Edmonton residents inclusion current tax per and the proposed outlook for the year ahead.

Get a free Edmonton Property Assessment and sell for the right price

The City of Edmonton distributes property tax notices in late May every year and asks property owners to pay their taxes in full by the due date of June 30 to avoid late-payment penalties. MyProperty Site Sign up or sign in to explore your property assessment and tax data. Launch MyProperty Property Tax Estimator

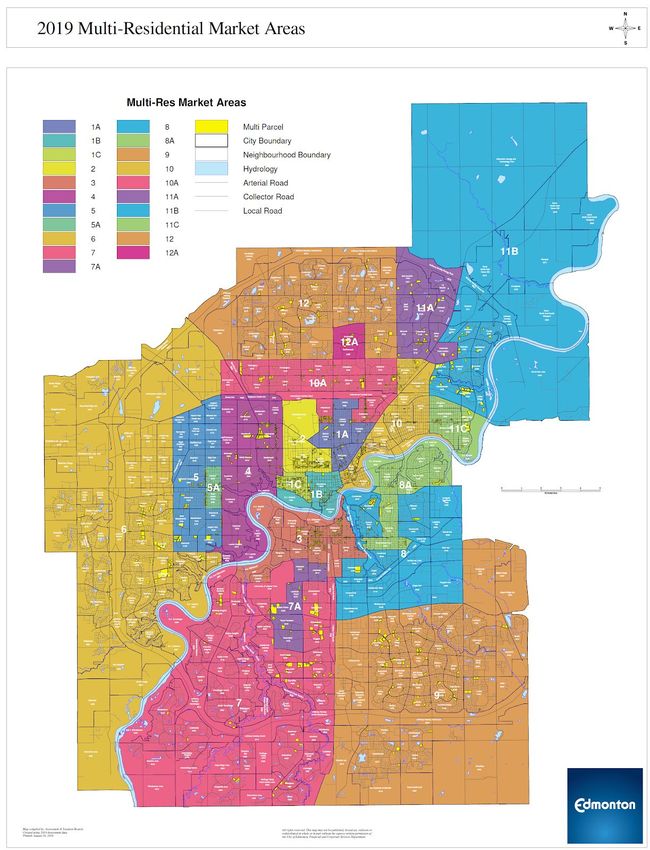

2019 ASSESSMENT METHODOLOGY MULTIRESIDENTIAL LAND City of Edmonton

Edmonton Property Assessment Overview Dataset Information Search Result This dataset includes 360 thousand properties within the City of Edmonton assessed by City of Edmonton, Assessment and Taxation Branch. Each property is registered with account number, location address, assessed value and history, etc.

Real estate website offers comprehensive sale history, assessments of

Every year, Edmonton assess properties based on guidelines set by the Alberta Assessment and Property Tax Policy Unit and the Ministry of Municipal Affairs Best 5-Year Fixed Mortgage Rates in AB Mortgage Term: 1-Yr 2-Yr 3-Yr 4-Yr 5-Yr Fixed Variable See More Rates

Property Assessment Edmonton Map STAETI

Property taxes vary greatly in Canada, ranging from 0.28% to over 2.6%. However, across the major cities Forbes Advisor Canada surveyed, the average tax rate is 1.12%.

Property Assessment Edmonton Map STAETI

your property assessed value x municipal tax rate = your municipal property taxes Overall, changes in property values do not affect the amount the City requires to continue providing municipal programs and services.