New sss contribution table 2023 Artofit

Here is the Voluntary Contribution SSS 2023/2024 Table and how to check your required monthly contribution as an employee in Philippines. Every year, the Social Security System publishes a payment plan outlining the mandatory monthly contributions for both workers and employers. Employees are responsible for remitting their monthly contributions either on their own or through.

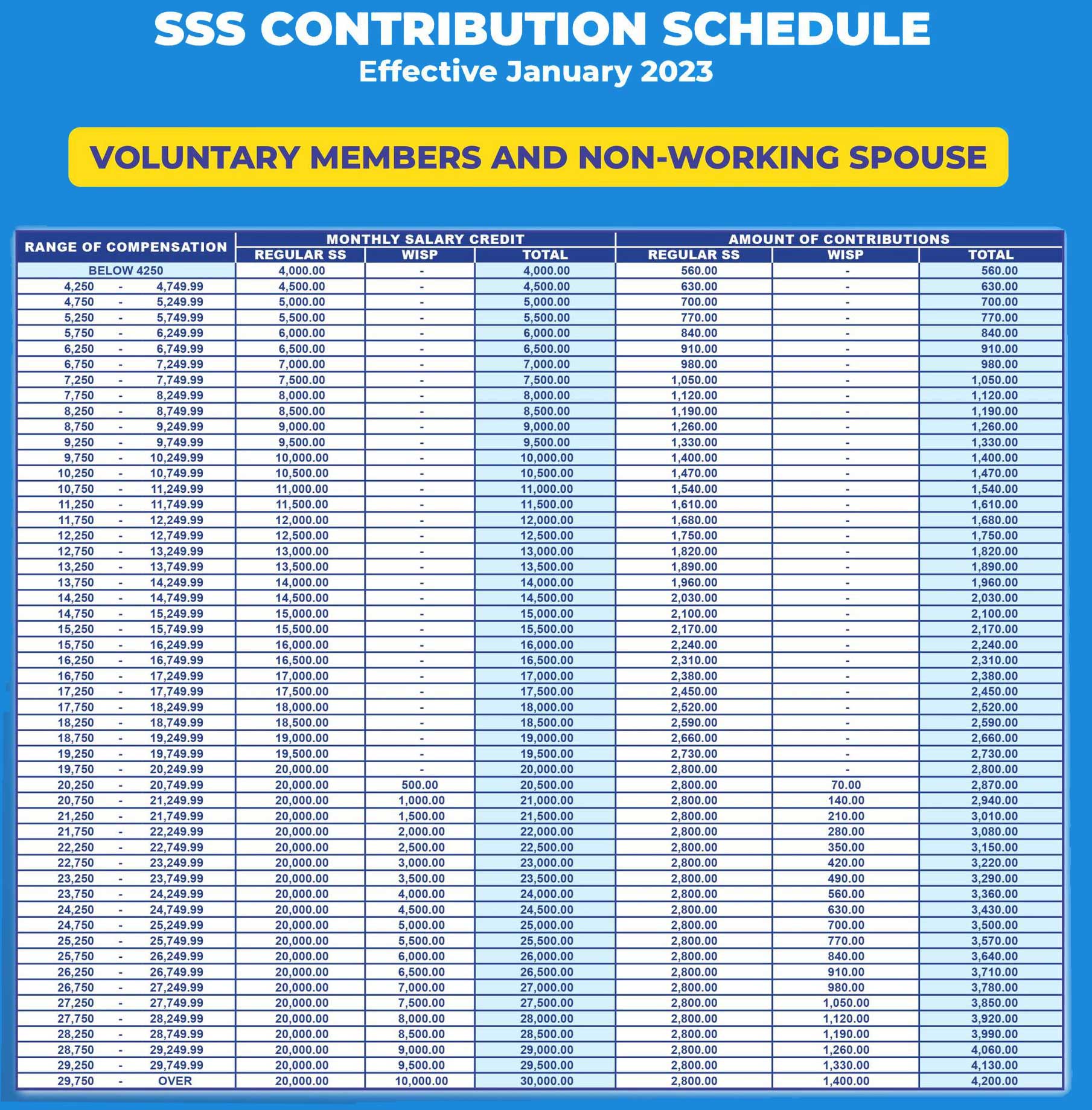

SSS Voluntary Members Contribution Table 2023

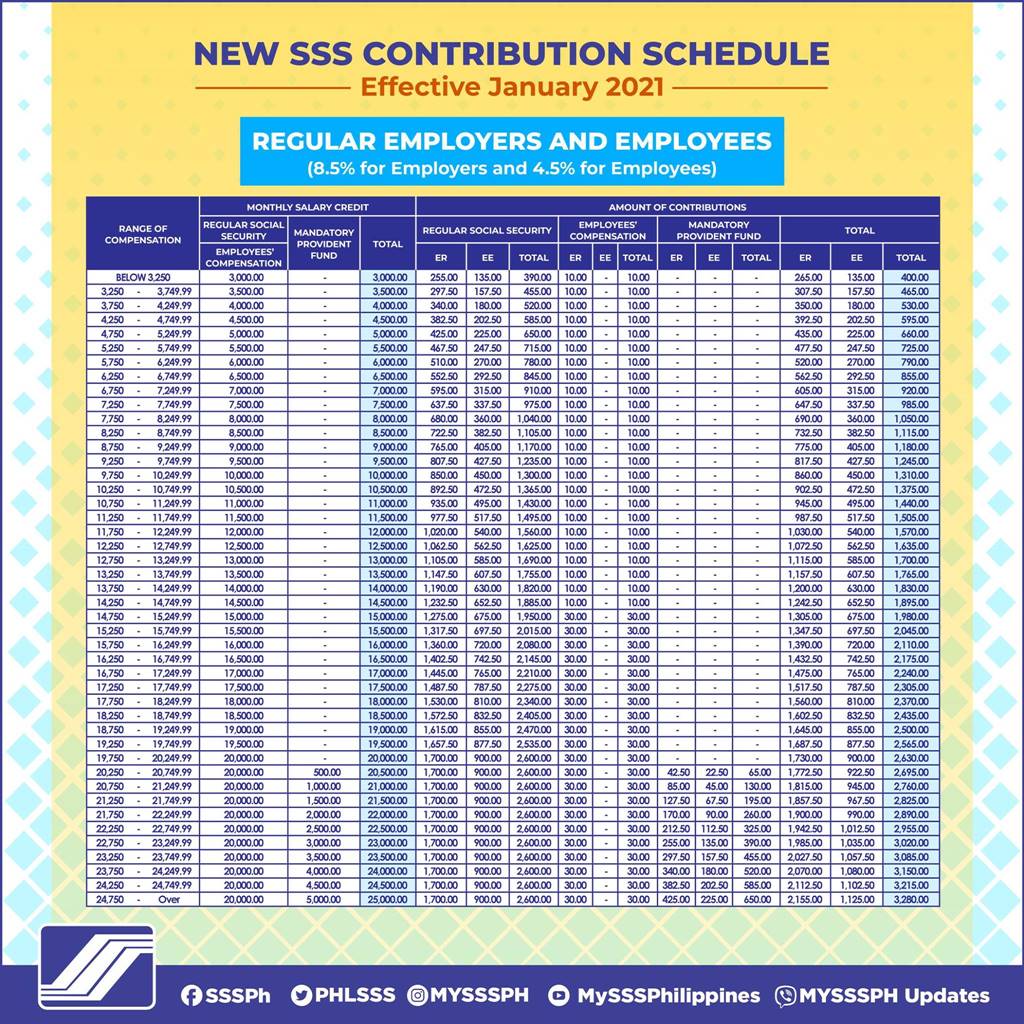

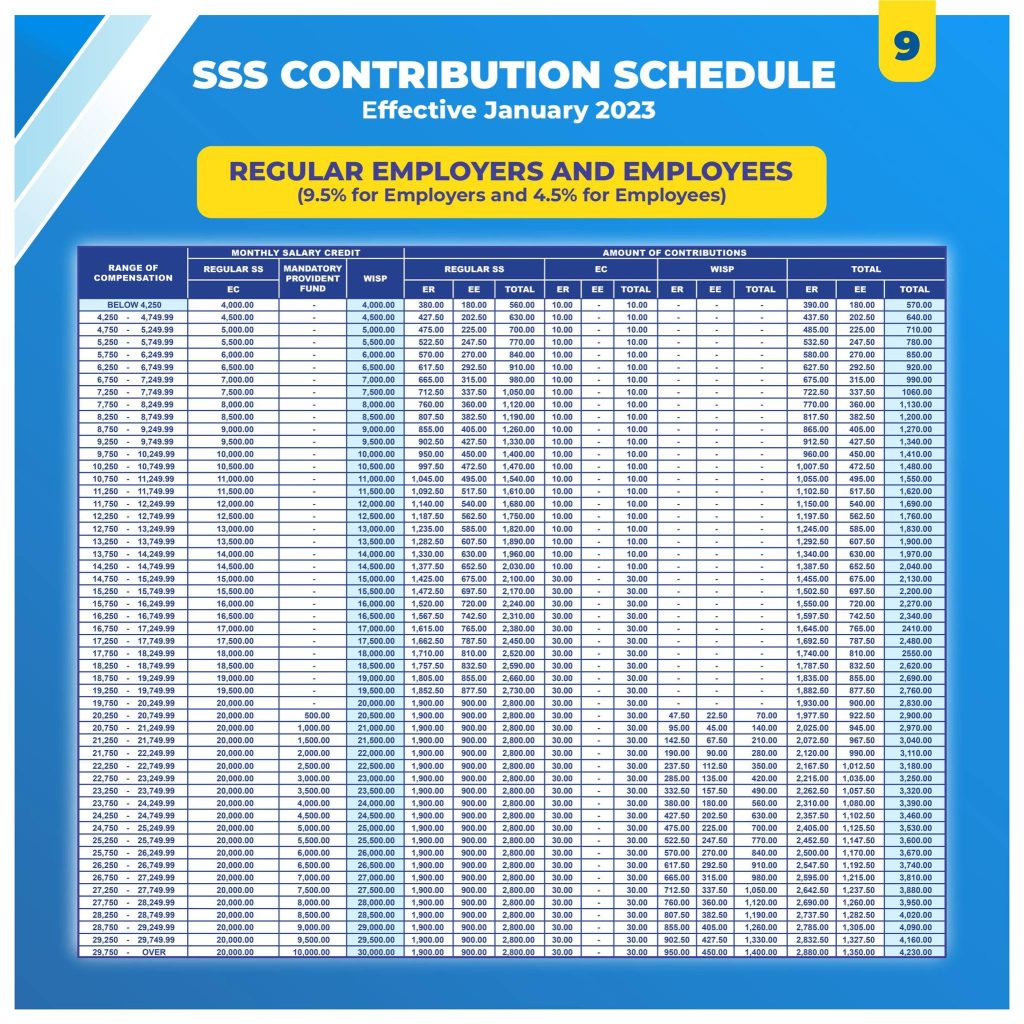

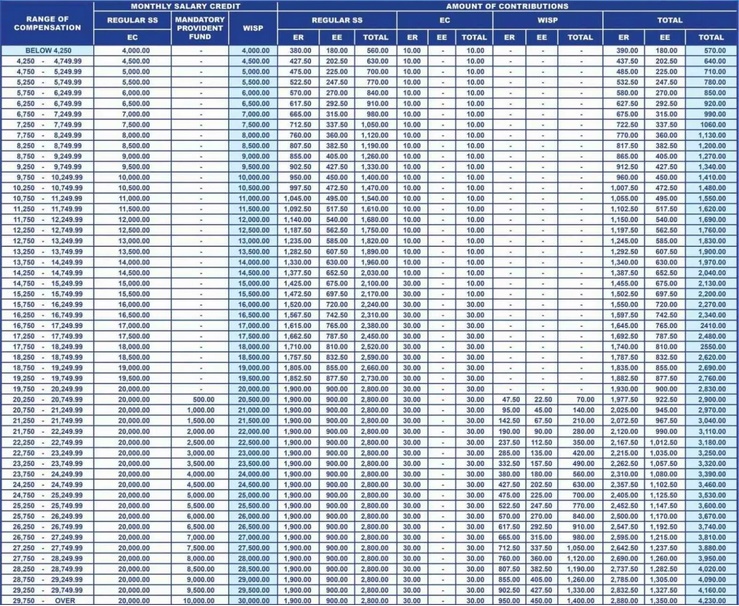

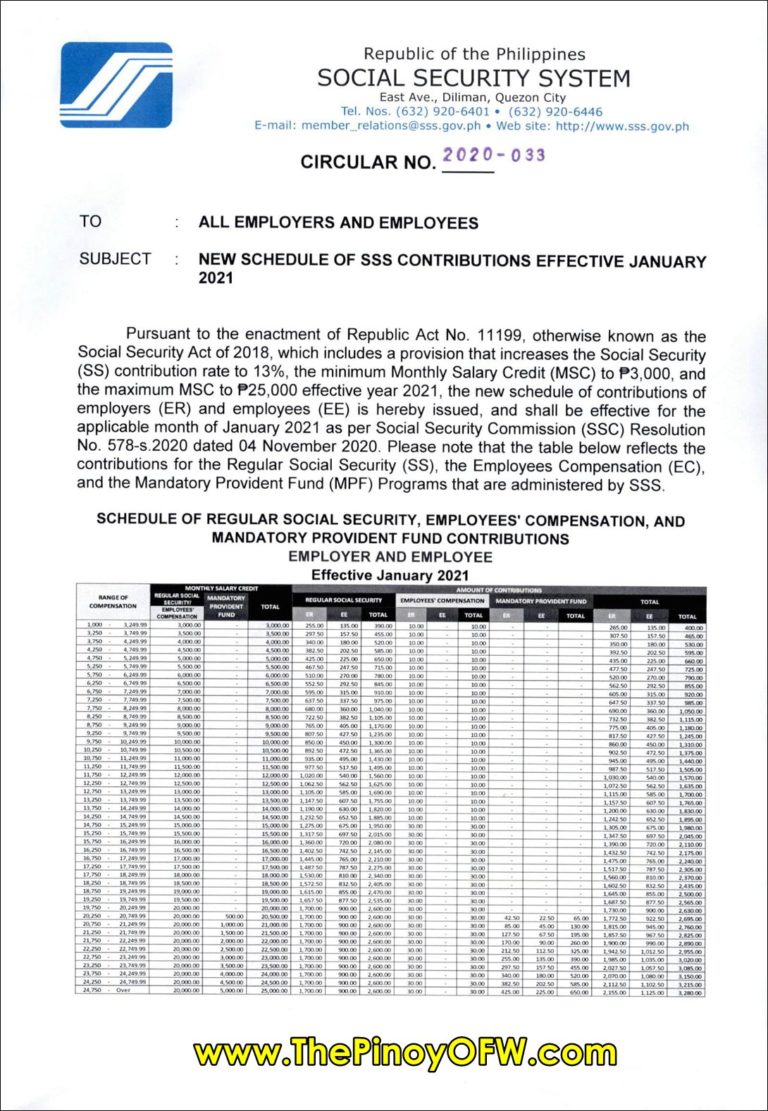

Significant Features of the 2023 Contribution Schedule Employees For Employers (ER) and Employees (EE) contributing at an MSC of ₱20,000 and below: Additional monthly SSS contributions range from ₱40 to ₱200, which will be paid by the employer only. For ER and EE contributing at the maximum MSC of ₱30,000:

SSS Voluntary Contribution How Freelancers Can Pay ModernFilipina.ph

Calculation: Contribution = 11% (Contribution Rate) x 18,000 PHP (MSC) = 1,980 PHP. In brief, calculating the contributions utilizing the 2023 SSS Contribution Table involves determining the MSC (Monthly Salary Credit) based on the revenue and locating the corresponding contribution rates.

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

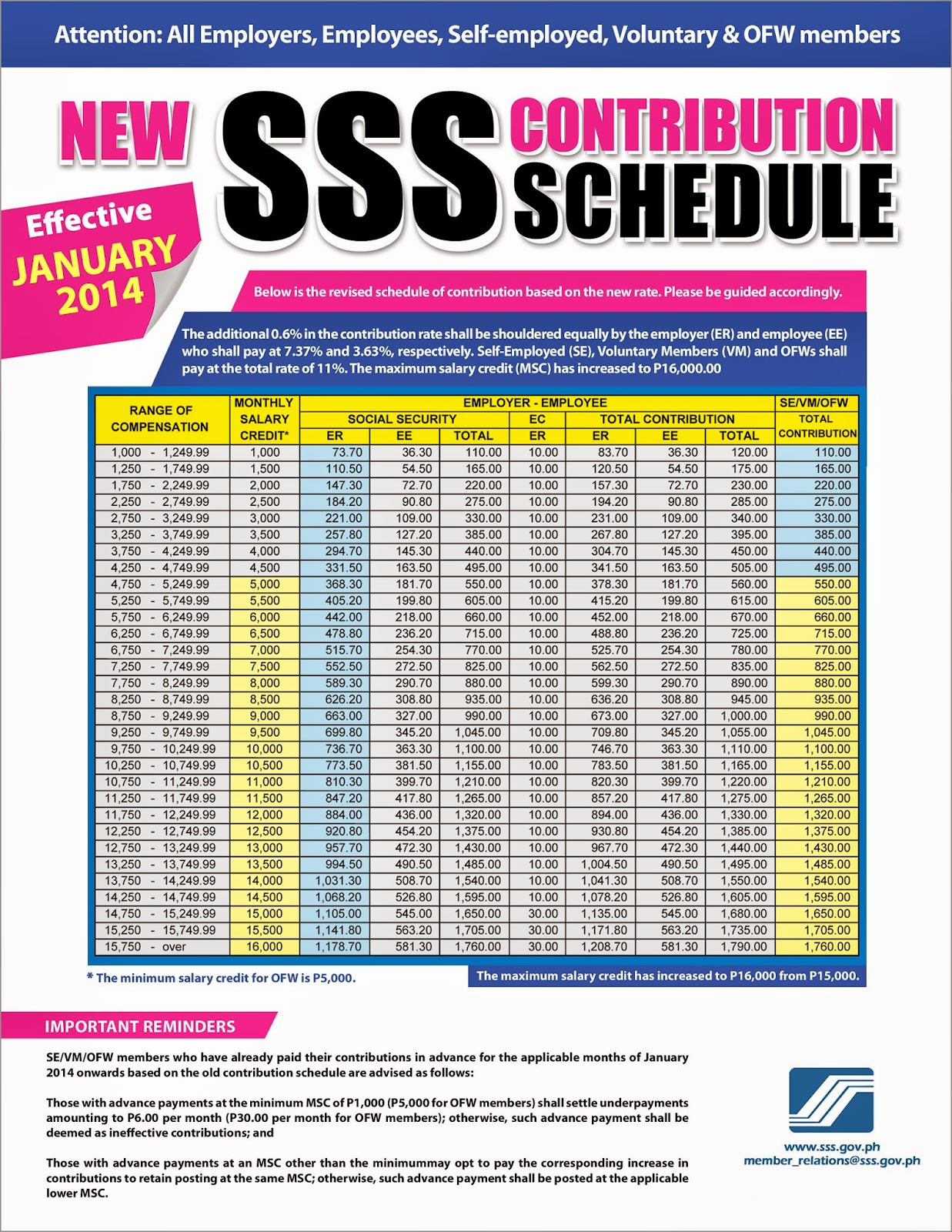

New SSS Contributions Effective 2023 Updated: May 15, 2023 Pursuant to Republic Act No. 11199, otherwise known as Social Security Act of 2018 which includes provision that increases the SSS Contribution rate effective January of the year of implementation as follows:

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

effective year 2023, the new schedule of contributions of ER and EE is hereby issued and shall be effective for the applicable month of January 2023 as per Social Security Commission (SSC) Resolution No. 751-s.2022 dated 25 November 2022. The table below reflects the contributions for SS, the Employees' Compensation (EC) and the Workers'

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers

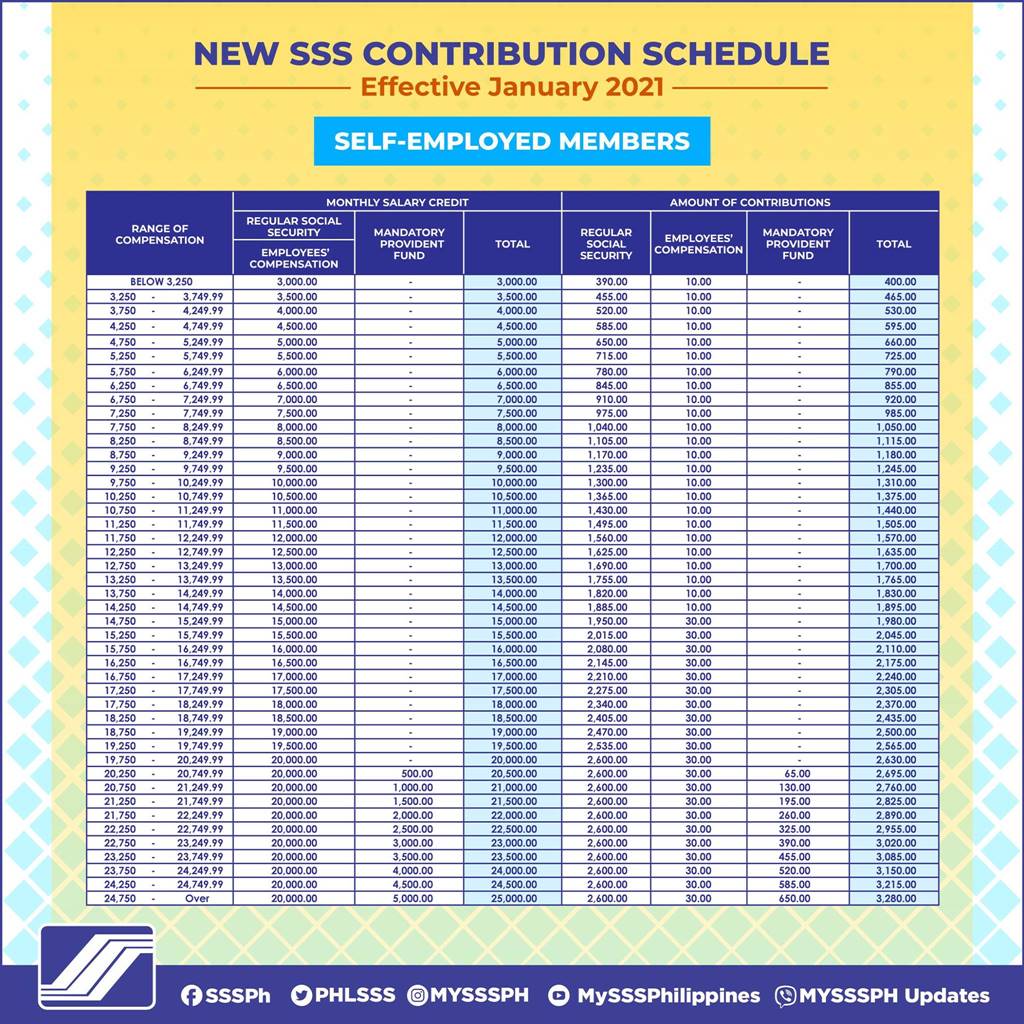

Below is the SSS monthly table of contributions schedule starting January 2023 for Voluntary Members and non-working spouses: For Voluntary Members/Non-Working Spouses, the minimum and maximum total monthly contributions are PHP 560.00 and PHP 4200.00, respectively. 2023 SSS Monthly Contribution for Household Employers and Domestic Helpers

How to Compute for SSS Contribution « EPINOYGUIDE

VOLUNTARY MEMBER & NON-WORKING SPOUSE RANGE OF COMPENSATION MONTHLY SALARY CREDIT AMOUNT OF CONTRIBUTIONS. Members who have already paid their contributions in advance for the applicable months of January 2023 onwards based on the old contribution schedule are advised as follows: 1. Those with advance payment at the minimum of ₱3,000.00.

New SSS Contribution Table 2023 in 2023 Cross stitch fairy, Sss, Save

Employee Monthly Contribution: New SSS Contribution Table for 2023 2023 Update: Based on SSS Circulars No. 2022-033, 034, 035, 036, and 037 signed by SSS President and CEO Michael G. Regino, the contribution rate for 2023 is 14%, which is one percent higher than for the previous year.

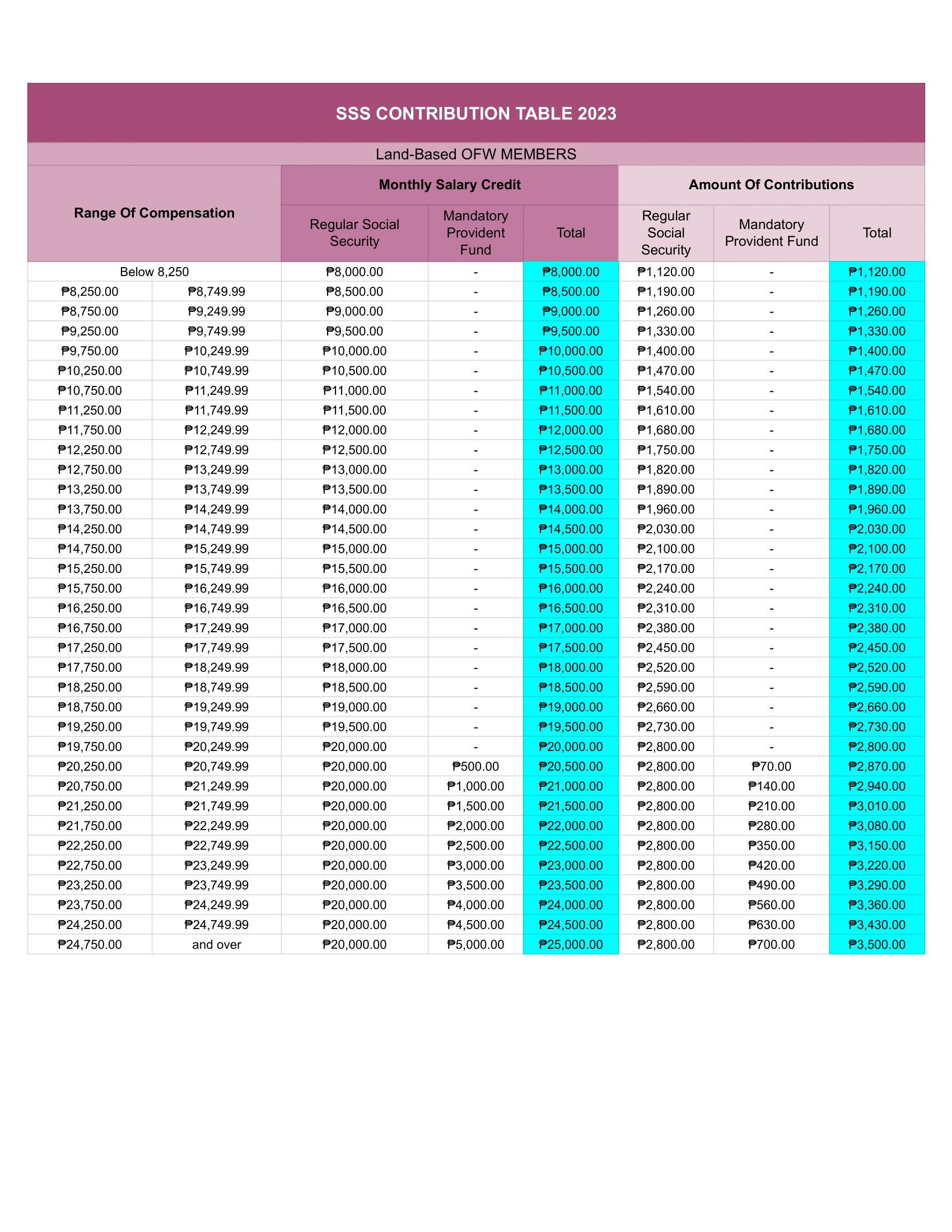

SSS Contribution Table 2023 Voluntary, Self Employed, Kasambahay, and OFW

The SSS Contribution Table helps Voluntary, Self Employed, and OFW members determine the monthly contribution amount they have to pay with SSS. The Chart guides regular employees to know the percentage of contribution payments they have to share with their employers.

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

Starting in 2024, the monthly contribution rate for Pag-IBIG will increase from 1% to 2% of the employee's monthly compensation. The agency also plans to raise the Monthly Fund Salary from P5,000 to P10,000 for 2024. Consequently, members will now contribute P200 monthly, with employers matching this amount.

SSS Contribution Table 2023 Here's Guide on Members Monthly

ALL VOLUNTARY AND NON-WORKING SPOUSE MEMBERS NEW SCHEDULE OF SOCIAL SECURITY (SS) CONTRIBUTIONS EFFECTIVE JANUARY 2023 Pursuant to Republic Act No. 11199, otherwise known as the Social Security Act of 2018, which includes a provision that increases the SS contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximu.

Rate SSS Contribution 2023 Here's Guide on How Much You Must Pay as

Pursuant to the enactment of Republic Act No. 11199, which includes a provision that increases the contribution rate to 14%, the minimum Monthly Salary Credit (MSC) to P4,000, and the maximum MSC to P30,000, the new SSS Contribution Schedule of employers (ER), employees (EE), self-employed, voluntary members, kasambahay, and non-working spouse i.

GUIDE SSS Contribution Table 2023 WhatALife!

Easily calculate your monthly contributions based on your income and employment status. Our user-friendly calculator will help you determine your contribution and provide you with a breakdown of your monthly contribution based on your salary range. The SSS table is regularly updated to ensure that you have access to the most current rates.

SSS releases contribution table for OFWs; P2,400 premium payment takes

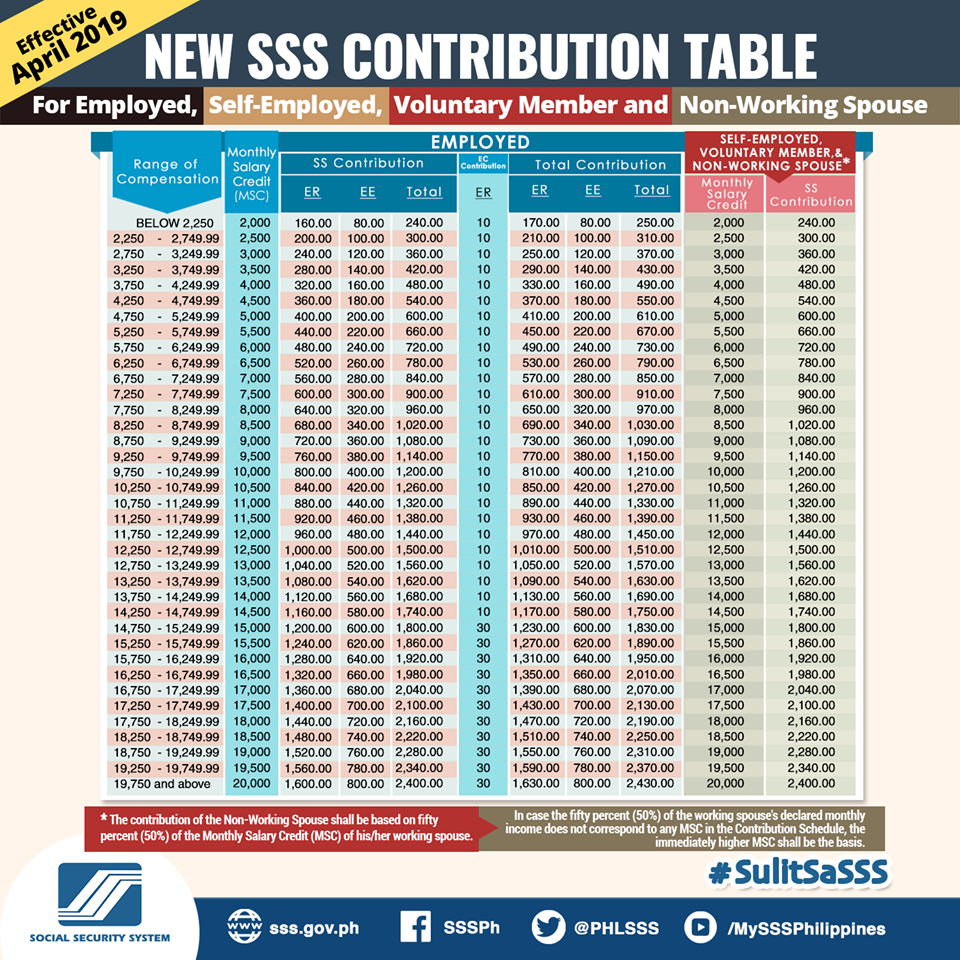

Monthly Contribution for Voluntary Members Voluntary SSS members can choose their desired monthly salary credit (MSC) ranging from Php 1,000 to Php 20,000. Your MSC determines your monthly contributions and potential SSS benefits. Voluntary members should pay the following based on their selected MSC: Minimum contribution: Php 240

New SSS Contribution Table 2023 Schedule Effective January

monthly salary credit amount of contributions regular ss wisp total regular ss ec wisp total ec er ee total er ee total er ee total er ee total below 4,250 4,000.00 - 4,000.00 380.00 180.00 560.00 10.00 - 10.00 - - - 390.00 180.00 570.00

SSS Monthly Contribution Table & Schedule of Payment 2023 The Pinoy OFW

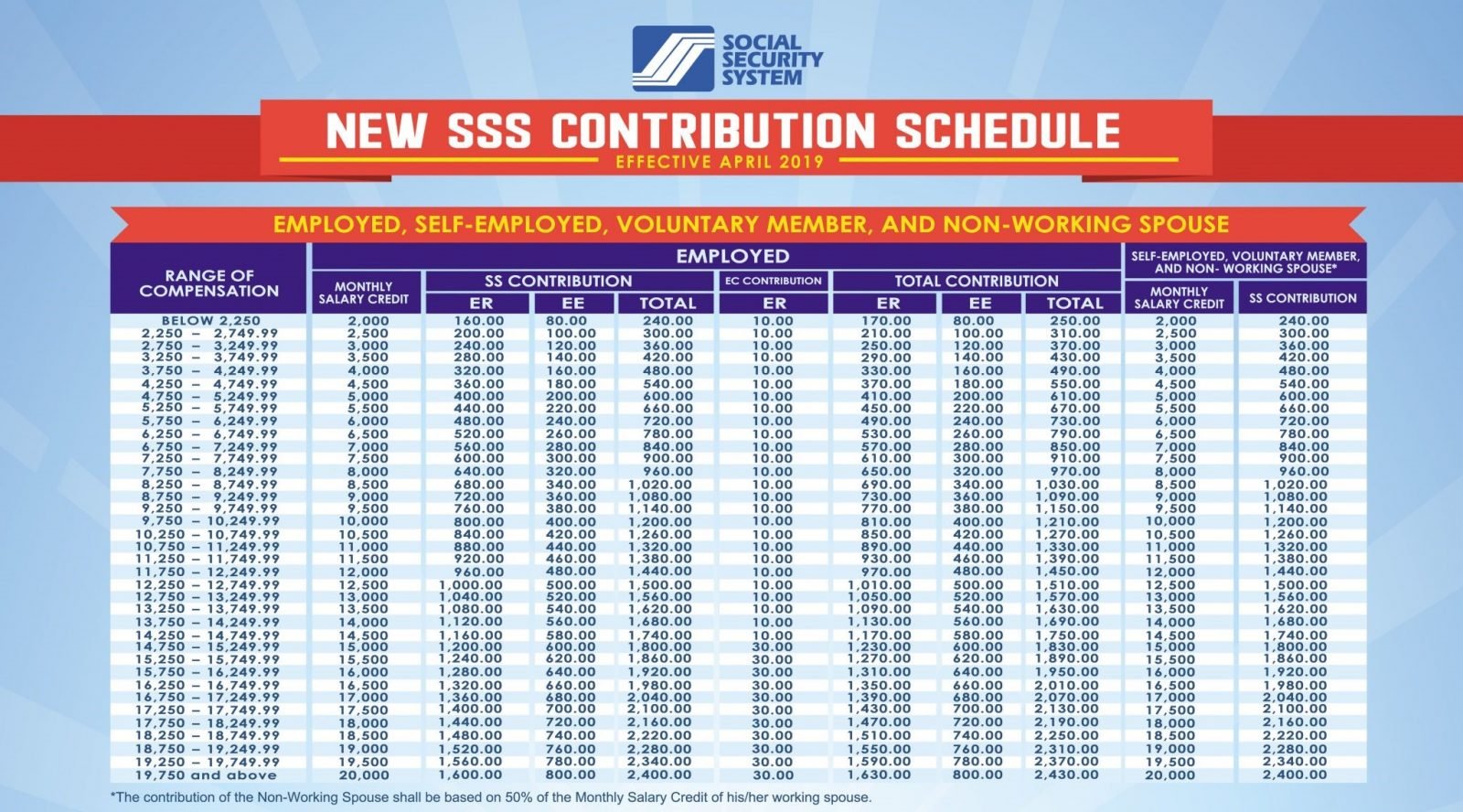

The new SSS Contribution table for voluntary and non-working spouse has been updated this 2021. It's current minimum compensation range is set to ₱3,250 with a total contribution of ₱390. Meanwhile, the maximum compensation range is pinned at ₱24,750 with a total contribution of ₱3,250.